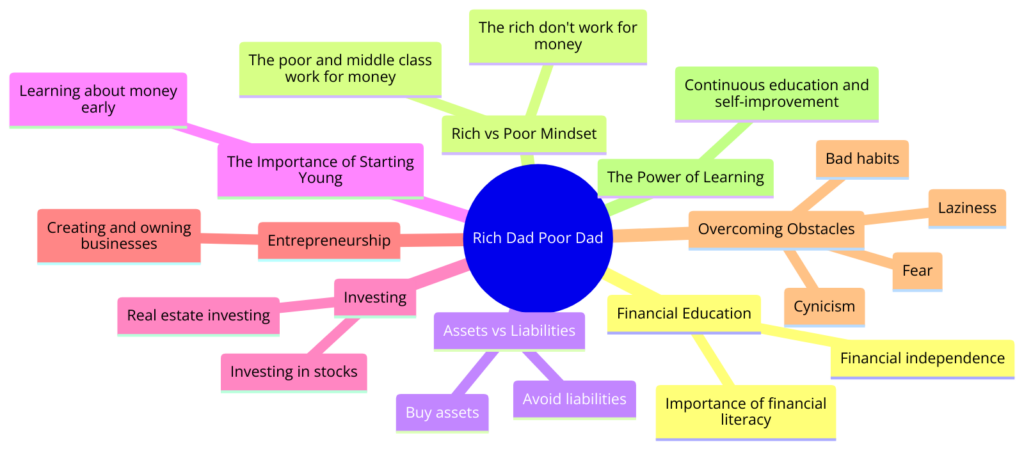

“Rich Dad Poor Dad” by Robert Kiyosaki, published in 1997, remains essential reading for anyone looking to understand and transform their relationship with money. Through contrasts between his “poor dad” — his biological father who valued job security and traditional education — and his “rich dad” — his friend’s entrepreneur father — Kiyosaki unveils timeless principles on wealth creation. This book dismantles myths surrounding money and employment, offering strategies for achieving financial independence that are even more relevant in today’s fluctuating economy. Discover crucial lessons for building a solid financial future.

“Rich Dad Poor Dad”, written by Robert Kiyosaki, is a book that explores the differences in mindset between the wealthy and the less fortunate regarding money and investment. The author uses the example of two fathers: his “poor dad,” his biological father, who values traditional education and a stable job yet remains financially insecure, and his “rich dad,” his best friend’s father, who is uneducated but very shrewd in business and becomes wealthy through his financial intelligence.

The book focuses on the importance of financial education and argues that it is not sufficiently addressed in traditional educational systems. Kiyosaki highlights several key concepts, such as the importance of learning to make money work for you, rather than working for money. He also encourages investment and calculated risk-taking as ways to generate wealth.

Through lessons from his “rich dad,” Kiyosaki presents ideas such as the difference between assets and liabilities, and the importance of acquiring assets that produce income streams. The book also criticizes the mentality of depending on a regular salary, which prevents people from pursuing opportunities to increase their wealth.

In summary, “Rich Dad Poor Dad” is a call to rethink our approach to money, to educate ourselves about finances, and to take proactive steps to improve our long-term financial health.

Key Points

1. The Difference Between Asset and Liability

Kiyosaki starts by clarifying two often misunderstood terms: assets and liabilities. He emphasizes that understanding this distinction is crucial for building lasting wealth.

- Assets: In the book, the example of real estate properties generating rental income serves to illustrate a typical asset. Kiyosaki explains how his early investments in small apartment buildings began to generate cash flow that exceeded his monthly expenses, bringing him closer to financial independence.

- Liabilities: Kiyosaki discusses purchasing his first luxury car, which he describes as a liability, not because of the car itself, but because of the monthly payments and ongoing maintenance costs that reduced his available income.

- Importance of Acquiring Assets: He stresses the importance of acquiring and maintaining assets that produce income.

- Minimizing Liabilities: Learning to differentiate wants from needs is a key strategy for minimizing liabilities.

- Strategies for Increasing Assets: Kiyosaki advises investing in financial education and actively seeking investment opportunities outside the traditional stock market.

2. Financial Education

Kiyosaki criticizes the educational system for its failure to teach basic financial skills, essential for managing personal money and creating wealth.

- Weaknesses of the Educational System: He recounts how neither he nor his “poor dad” received education on finance, limiting their understanding of investment opportunities.

- Self-Education in Finance: Kiyosaki shares anecdotes about reading books on real estate investing and attending seminars, which broadened his understanding of the market and investment techniques.

- Learning through Experience: The author describes his first purchase of an investment property as a pivotal moment in his financial education.

- Importance of Continuing Education: He emphasizes the importance of staying informed about economic and tax trends to optimize investment strategies.

- Developing Financial Intelligence: Example of how he learned to analyze financial statements to identify good and bad investments.

3. Work to Learn, Not Just to Earn

According to Kiyosaki, acquiring skills and knowledge should take precedence over merely working for a salary.

- Value of Learning at the Workplace: He recounts how working for a real estate entrepreneur taught him more about business than any course could have.

- Skills Diversification: Kiyosaki highlights the need to learn sales and marketing skills, essential to any successful business.

- Entrepreneurship: He explains how the skills gained while working for others served to build his own real estate empire.

- Active Learning: The author encourages seeking actively situations and jobs where learning is prioritized over immediate pay.

- Mentorship: The value of having mentors in various fields is underscored, with Kiyosaki sharing how his mentors taught him the subtleties of business and investing.

4. The Importance of Entrepreneurship

Becoming an entrepreneur is, according to Kiyosaki, the surest path to wealth. He explains why and how one can achieve this.

- Wealth Creation: Kiyosaki discusses how entrepreneurship allowed him to create systems that generate passive income, unlike a salaried job.

- Financial Control: Through examples of his own businesses, he shows how entrepreneurship offers more complete control over financial growth potential.

- Scale and Leverage: Using specific examples of businesses, he details how to use other people’s resources (money, time, skills) to build a business.

- Tax Benefits: Kiyosaki explains tax structures that can benefit entrepreneurs, such as specific deductions and tax credits.

- Impact and Legacy: He shares his view of entrepreneurship not only as a means to make money but also to contribute positively to society and leave a lasting legacy.

5. Making Money Work for You

Kiyosaki emphasizes the importance of investing in a way that your money works for you, rather than the other way around.

- Passive Investments: He uses the example of rental properties he acquired early in his career and how they continue to generate income without daily involvement.

- Reinvestment of Earnings: Kiyosaki recounts how he reinvested the profits from his early real estate investments into larger properties, demonstrating the effect of compounding.

- Strategic Use of Debt: He describes how he used debt to finance real estate purchases that generated significantly more income than the costs of the loans.

- Investment Automation: The example of how he set up automatic contributions to investment funds when he started earning money illustrates this principle.

- Continuing Financial Education: Kiyosaki stresses how crucial it is to stay informed and educated about the financial markets to make sound investment choices.

6. Overcoming Obstacles and Fears

Finally, Kiyosaki addresses the psychological challenges of investing and managing money.

- Fear Management: He shares personal stories about how he overcame the fear of losing money, focusing on opportunities rather than risks.

- Failures as Learning Opportunities: Anecdotes about his own failures and how they helped him become financially wiser.

- Risk Mitigation Strategies: Kiyosaki explains his strategies for reducing risks, including diversification of investments and thorough research before engaging in new ventures.

- Planning and Preparation: He details his processes for assessing investments and planning long-term strategies.

- Networking with Other Investors: Kiyosaki concludes by the importance of building a support network, sharing examples of how his contacts opened doors and offered valuable advice.

Conclusion

“Rich Dad Poor Dad” by Robert Kiyosaki is a must-read for anyone wanting to challenge their preconceived notions about money and investment. The book offers a fresh and provocative look at managing personal finances, highlighting the importance of financial education, often overlooked by the traditional school system. Through comparisons between the “poor dad” and the “rich dad,” Kiyosaki explains how financial perspectives can significantly influence economic stability and wealth creation. This book personally encouraged me to reconsider how and why I manage my money in certain ways and motivated me to be more proactive in learning about investing.

For those who find Kiyosaki’s approach inspiring and wish to deepen their understanding of personal finances, I also recommend reading:

- “The Millionaire Next Door” by Thomas J. Stanley, for a data-driven perspective on the habits of wealthy individuals.

- “Think and Grow Rich” by Napoleon Hill, which explores the power of transformative thinking in the pursuit of wealth.

- “The Total Money Makeover” by Dave Ramsey, which offers practical strategies for reducing debt and building financial security.

These books complement Kiyosaki’s teachings by offering both practical strategies and motivation to transform your financial approach.